The financial industry has been unarguably influenced positively by the ever evolving everyday technology that keeps pushing new phases of development. Fortyseven as an institution was created solely to serve as an intermediary between digital currency and monetary economies.

With full compliant to all the key bank directives and requirements, the platform offers sales and purchase feature, investment and exchange options alongside current accounts and crypto-saving. One of the landmark innovation that surely makes the platform standout is the multi-asset account which brings together a client’s every account together on a single platform for better management with the inclusion of crypto currency accounts and easy tracking of investments from all the added banks.

Cryptobonds, another interesting addition will be traded on an entirely different platform(s). With the availability of bank experts, companies are offered a way out on the platter of gold regarding sorting out issues that might have occurred with their bank accounts.

THE MISSION OF FORTY SEVEN BANK

Provision of an innovative financial services that are user friendly for prospective clients. We tend to infuse the native way of banking with the crypto world in order to provide unique opportunities.

FORTY SEVEN’S PARTNERS

THE VALUES

- Customer satisfaction

- Profit for all stakeholders

- Transparency

- Innovativeness

- Financial stability

- Security and privacy

- Market share growth and worldwide expansion

- Effectiveness and user-friendly procedures

PRODUCTS AND SERVICES

With clients ranging from private persons to business owners, developers and traders, our products and services are aimed towards every one of these clients regardless of their status quo.

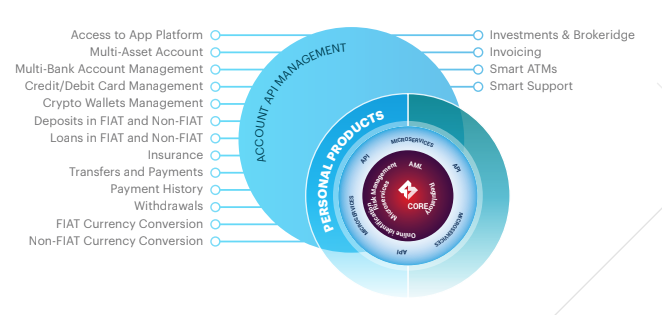

PRODUCTS FOR PRIVATE PERSONS

At forty seven bank, the services and products available for use by private persons includes but not limited to insurance, payment and transfers, investments, cash withdrawals at ATMs, payment history & analysis, deposits/loans, smart and efficient support.

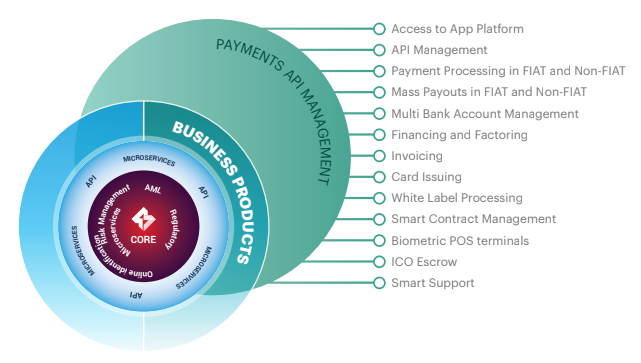

PRODUCTS FOR BUSINESS

The forty seven bank services and products available for business(es) includes, biometric POS terminals, application platform and API management, ICO practices alongside payment processing and invoicing.

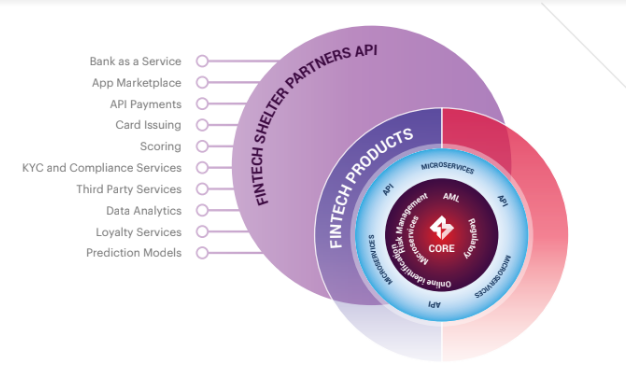

PRODUCTS FOR DEVELOPERS

For developers, the forty seven bank services available to them includes, consulting services, developer meetups, KYC, forty seven app platform, data analysis plus prediction models and compliance services.

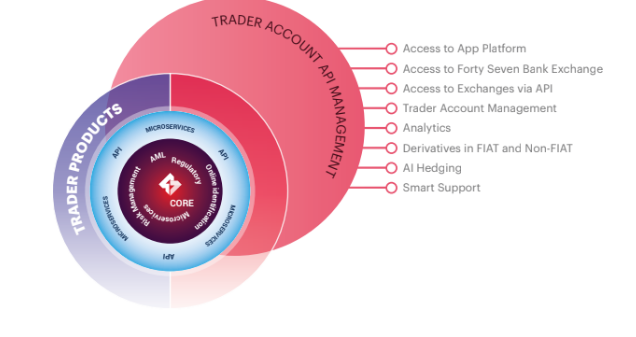

PRODUCTS FOR TRADERS

Access to forty seven bank exchange and app platform, derivatives, cryptobonds, smart support, hedging, analytics and cryptofutures,

INITIAL COIN OFFERING (ICO)

The forty seven bank token is abbreviated FSBT and is based on the ERC20 standard and also in future through smart contracts. The forty seven bank token holders can exchange ETH into FSBT but for now, the token will be exchanged for ethereum and bitcoin at the price of 0.0047 ETH per token.

The first round of the ICO started on 16th November 2017 and ended on 16th December 2017. The second round of the ICO is yet to be announced. The forty seven bank softcap is valued at 3600 ETH while the hardcap is valued at 36000 ETH.

One token – 0.0047 ETH

ICO Hardcap – 36000 ETH

ICO Softcap – 3600 ETH

Duration of ICO round 1: 16 November – 16 December, 2017

Duration of ICO round 2/3: to be announced soon.

BONUS STRUCTURE

- ICO Round 1: 30% bonus

- ICO Round 2: 20% bonus

- ICO Round 3: 0% bonus

TOKENS

Abbreviation: FSBT (Forty Seven Bank Token)

Actual rate: 1 FSBT = 0.0047 ETH (including current bonus)

Maximum amount of tokens to be generated: 5 555 555 FSBT

Softcap: 3600 ETH.

Hardcap: 36000 ETH.

Accepted currencies on ICO: ETH, BTC

ICO: now – 30.042018.

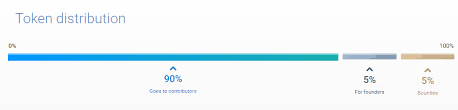

TOKEN DISTRIBUTION

Contributors – 90%

Founders – 5%

Bounties – 5%

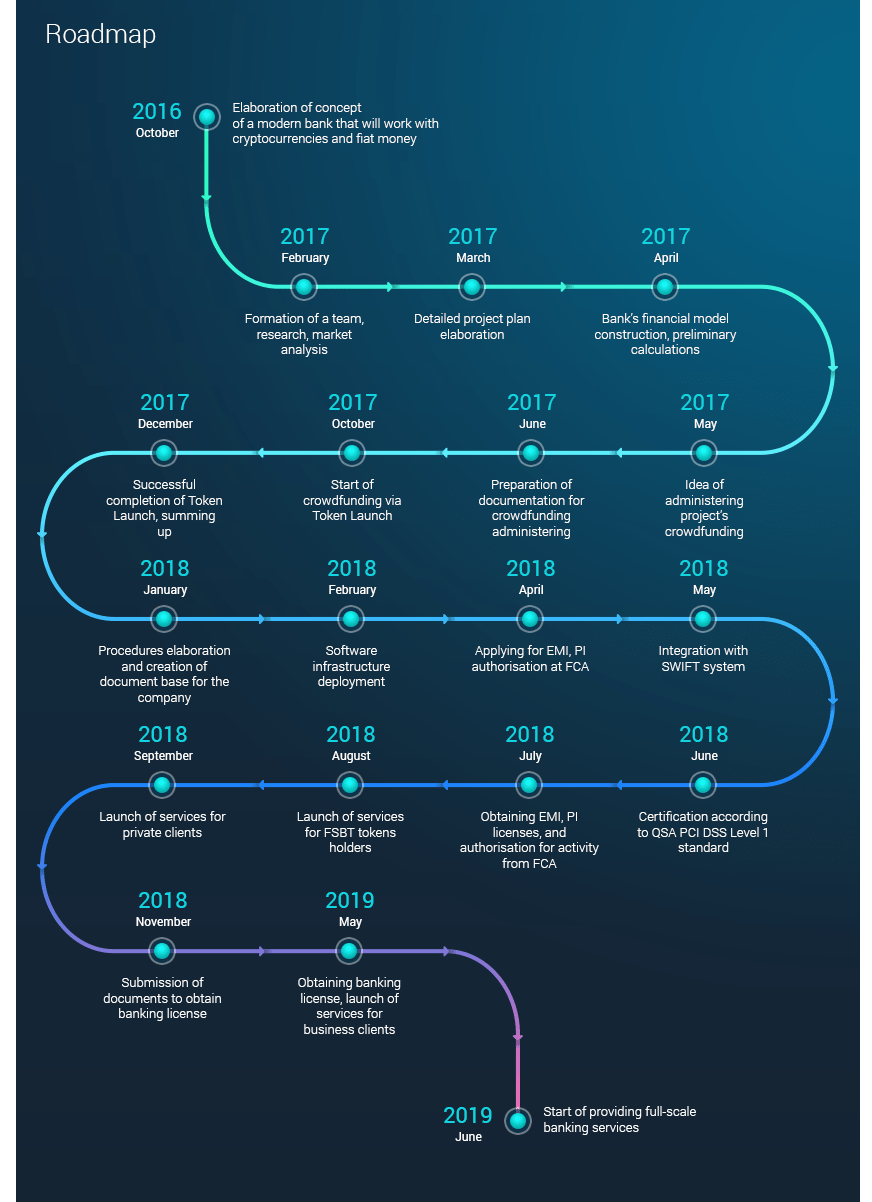

ROADMAP

2016

OCTOBER – idea to create the innovative bank that will offer product and services for cryptocurrencies

2017

FEBRUARY – beginning of work, team building, research and market analysis

MARCH – development of detailed plan of the project

APRIL – construction of financial model of the bank, preliminary calculations.

MAY – decision of attract financing through ICO

JUNE – preparation for documents necessary for ICO

OCTOBER – ICO smart contract test period

NOVEMBER – ICO start

DECEMBER – development of procedures and creation of document base for the bank

2018

FEBRUARY: deployment of software

APRIL: application for EMI, PI and trading authorization at FCA

MAY: connection to SWIFT

JUNE: passage of QSA PCI DSS level 1

JULY: receipt of EMI,PI and trading authorization from FCA

AUGUST: start of products and services offering to FSBT token holders

SEPTEMBER: start of products and services offering to private customers

NOVEMBER: application for banking license

2019

MAY: receipt of banking license and part of products and services offering to business customers and developers

JUNE: bank begins to attract deposits and offer full range of products and services.

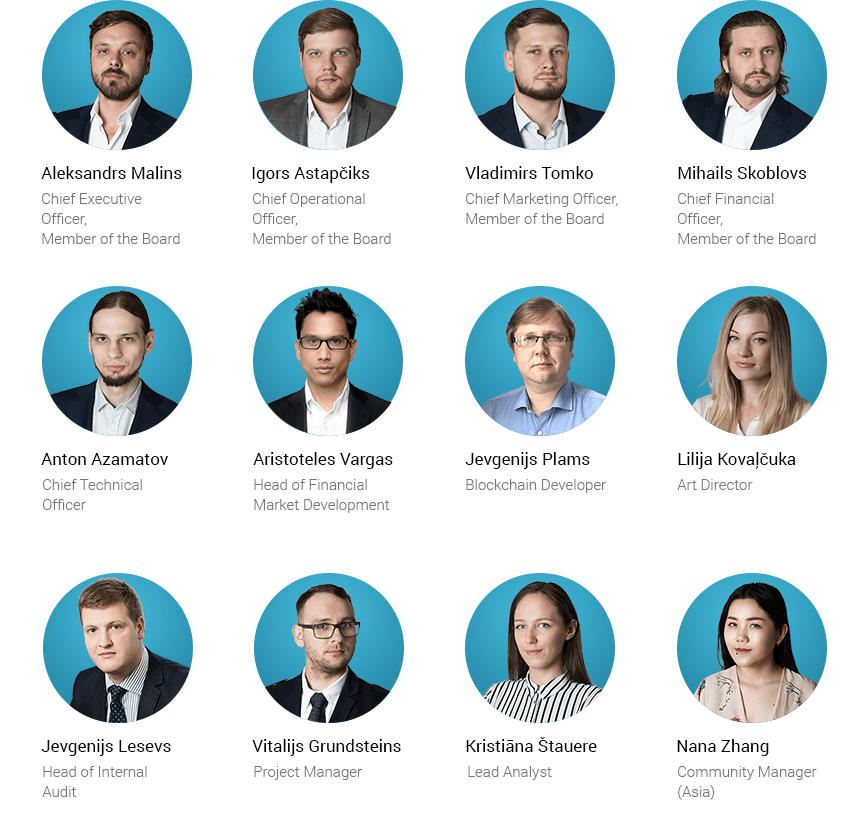

OUR TEAM AND ADVISORS

Aleksandrs Malins – Chief Executive Officer, Member of the board

Igors Astapciks – Chief Operational Officer, Member of the Board

Vladimirs Tomko – Chief Marketing officer, Member of the Board

Mihalis Skoblovs – chief Financial Officer, Member of the Board

Ariistoteles Vargas – Head of Financial market development, Member of the Board

Anton Azamatov – Chief Technical Officer

Edgars Abols – Chief legal Officer

Lilija Kovalcuka – Art Director

Jevgenijs Lesevs – Head of Internal Audit

Vitalijs Grundsteins – Project Manager

Kristiana Stauere – Lead Analyst

Nana Zhang – Community Manager (Asia)

Victor Chow – Founding and Managing partner, LVL88

Claude Chi – Chief marketing Officer, Afterpiece Investment

Morten Hansen – Head of Economics Department, Stockholm School of Economics in Riga

Dmitry Dudin – Head of Products andServices development Department, XB Software

Rinat Arslanov – Chief executing Officer, Revain

Artem Kushik – Business Analyst, Credit Agricole CIB

Igors Danilovs – CFA, Senior Portfolio Manager, Swedbank

Jevgenijs Plams – Blockchain Developer

Inna Krievane – Financial analyst, argus Vickers

Dianna Chen – Strategy & Product Development Lead, Fier Consulting

Miguel Sanchez de Pedro – Senior Partner and Founder, OxValue Advisers SL

Chen SiYuan – Co-founder, Northern capital Investment company.

OBJECTIVE CONCLUSION

The fortyseven bank with its unique services will without doubt affect the world in the most effective and unexpectedly positive way. Be a part of the team that is driving towards success at a very high speed. For more detailed information about the fortyseven bank project and to be in the know about our every change(s) simply follow the links below this article.

Website: https://www.fortyseven.io/

Facebook: https://www.facebook.com/FortySevenBank/

Twitter: https://twitter.com/47foundation

Telegram: https://t.me/thefortyseven

Medium: https://medium.com/@fortyseven47

Bitcointalk: https://bitcointalk.org/index.php?topic=2225492

Published by: kessylezul

Profile URL: https://bitcointalk.org/index.php?action=profile;u=1910183

Telegram Username: kessylezul

ERC20 Wallet: 0x7eeBa24c32Efcf5f971053c315Cd593BbB3F5698

EmoticonEmoticon